9 Money-Saving Challenges to Motivate You to Save Up for Your Dream Condo

Think you can never save up for your dream condo? Think again. Here's a real-life story to inspire you to start saving and spending wisely.

At age 35, Ibin Sobejana experienced condo living in the Philippines for the first time in 2015 when he moved in with his cousin to a one-bedroom unit at Sorrel Residences. Their parents didn’t buy it for them. They didn't win the lottery, either.

The cousins are proud that they bought a condo unit using their savings. Ibin, for instance, saved and invested his money in the stock market. He bought DMCI Homes shares at low prices and sold them later at higher prices.

"We really worked hard for it. We did not ask for help from our parents, aunt or others," Ibin shared.

See? Making your dream condo a reality isn't a far-fetched idea. Even if you're a 20-something with a Php20,000 monthly salary, it's never too early to start building your condo purchase fund.

Getting a DMCI condo unit near your workplace is your ticket to independence and work-life balance. Need more motivation to save money to buy a condo? Check out these nine money-saving challenges and choose one that will work best for you.

1. 52-week saving challenge

Start saving on a weekly basis. Photo courtesy of kang_hojun via Pixabay

You might’ve chanced upon this saving strategy on social media. Don't ignore it this time. Why not give it a try? It simply involves setting aside a gradually increasing amount every week.

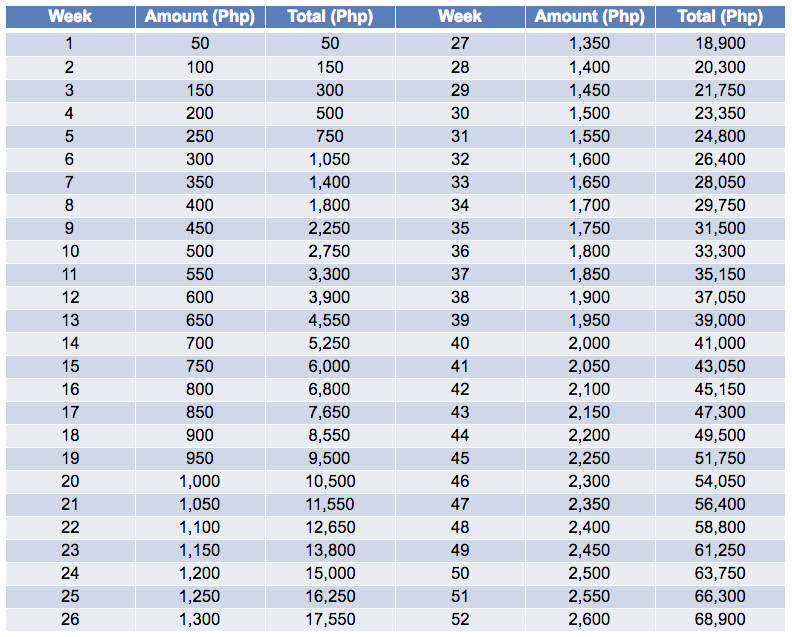

Start by saving Php50 on the first week, Php100 on the second week, Php150 on the third week, and so on until you reach week 52. By end of the year, you'll accumulate Php68,900 as long as you save continuously and don't touch your savings.

If you think Php50 is too small or big, you can tweak your weekly savings. Depending on your income, you may instead save in increments of Php20 (total savings of Php27,560 by week 52) or Php100 (total savings of Php137,800 by week 52).

To make it easier to remember the amount to save each week, print a table like the one below and stick it to your piggy bank.

52-week sample table you can replicate

52-week sample table you can replicate

2. Reverse 52-week saving challenge

For some, the 52-week saving challenge is extremely tough during the weeks when they have to save a thousand bucks and higher. It gets trickier during December when the idea of spending wisely goes right out of the window (oh, the many gifts to buy and parties to join!) while having to save over Php2,000 weekly.

Is the 52-week saving challenge an impossible challenge for you? Try doing it in reverse: save a decreasing amount per week, starting from Php2,600 on the first week until you reach week 52 when you need to save just Php50. By end of the year, you'll still save the same amount as you would with the regular 52-week challenge.

What makes it an effective way to save money is that seeing higher initial savings motivates you to save more.

3. Twice-a-month saving challenge

Most working professionals in the Philippines get paid twice a month, so they usually budget their salary for two weeks. This is why for these people, saving money every payday is easier than doing it weekly.

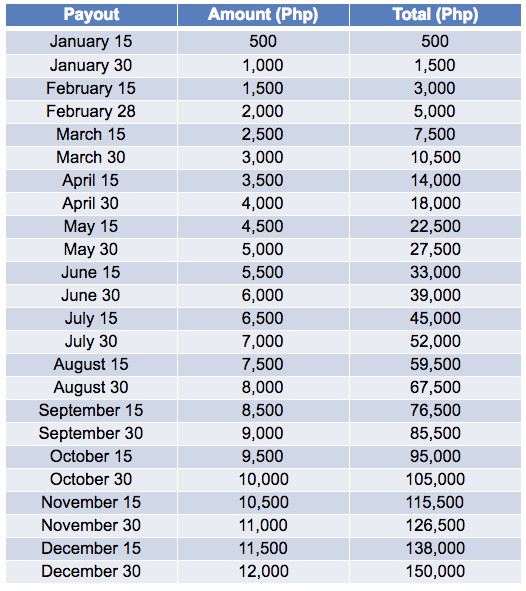

Interested in setting aside a portion of your income every payout? You can save in increments of Php50 to Php500, depending on your budget. By end of December, you’ll accumulate Php15,000 to Php150,000.

Here's how your savings will look like when you take this challenge, assuming that you receive income every 15th and 30th of the month and save in increments of Php500:

A money saving table if you want to start saving bi-monthly.

4. 12-month saving challenge

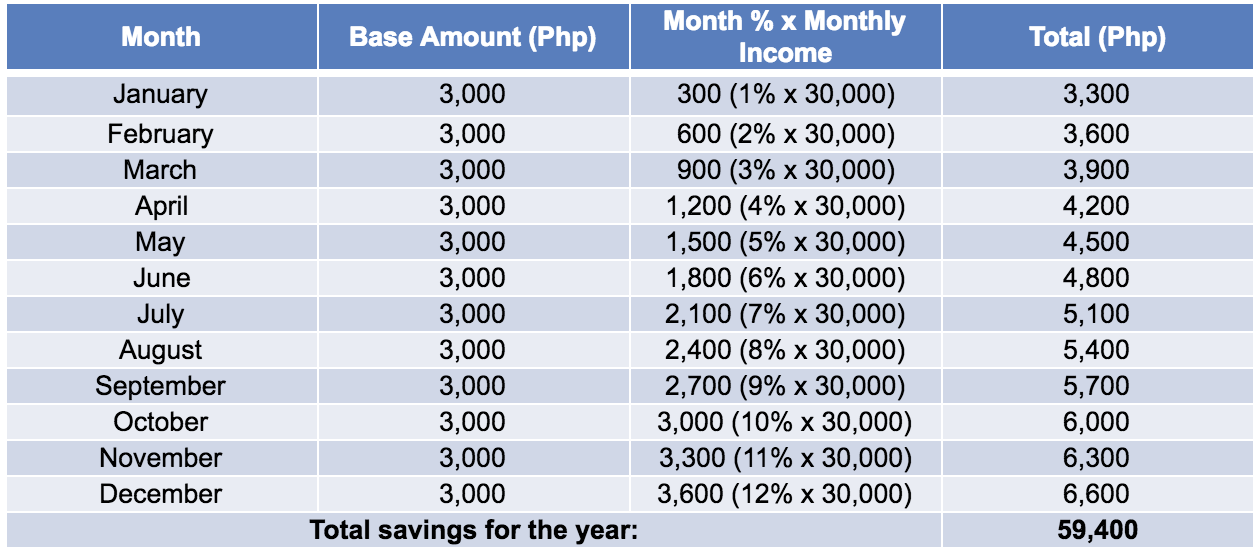

This is one of the money-saving challenges proposed as an alternative to the 52-week challenge. It involves setting a base amount (a fixed amount you’re willing to set aside monthly) plus a percentage of your monthly income that starts at 1% and gradually increases up to 12% by December.

In short, monthly savings = base amount + (month % x monthly income).

Let's say you're earning Php30,000 monthly, and your base amount is Php3,000. This table shows how much you'll save in a year through the 12-month saving challenge.

This money-saving table shows you a style to save every month.

This money-saving table shows you a style to save every month.

Your total savings may be higher or lower depending on your monthly income and your base amount.

5. Daily fixed savings challenge

Have a fixed amount of money to save. Photo courtesy of congerdesign via Pixabay

Have a fixed amount of money to save. Photo courtesy of congerdesign via Pixabay

Here’s for the peeps who want to save but hate to deal with lots of numbers: Save a daily fixed amount like Php100, and you'll gain about Php35,600 by end of December. Your total savings can be higher or lower depending on how much you can realistically save per day. Easy breezy, right?

6. 365-day money challenge

Grow your money saving daily. Photo courtesy of nattanan23 via Pixabay

Grow your money saving daily. Photo courtesy of nattanan23 via Pixabay

Like the daily fixed savings strategy, the 365-day challenge entails saving money every day. The only difference is that the daily amount increases each day.

Start with one peso on the first day, two pesos on the second day, three pesos on the third day, and so on until you save Php 365 on the last day of the year. All in all, your savings can grow to Php 66,795 by December 31.

7. 50-peso saving challenge

Php50 bills. Photo courtesy of florantevaldez via Pixabay

Php50 bills. Photo courtesy of florantevaldez via Pixabay

Still can't choose the right money-saving challenge for you? Sergio Osmeña could be your lucky charm this year. If you commit to saving at least one Php50 bill each day for the entire year, you'll earn a minimum of Php18,250. Grow your savings by keeping every Php50 bill you receive in a jar or box.

This clever money-saving hack came from a viral Facebook post of a young woman who saved Php42,300 in only five months through the 50-peso challenge. That's a whopping collection of 846 bills in less than half a year! Her story inspired some netizens to follow suit. Are you curious and inspired, too?

8. Spare piso challenge

Photo courtesy of lianasmithbautista via Pixabay

Photo courtesy of lianasmithbautista via Pixabay

You guessed it right—this challenge involves saving every spare change you receive.

You might wonder: "Seriously? How can you possibly buy a condo with one-peso coins?"

Don't underestimate the value of piso. We hate to sound like your elders, but it couldn’t be stressed enough: hindi ka makakabuo ng bente kung walang piso.

In other words, it helps you develop the habit of saving. Need we say more?

9. Save what you spend challenge

Make sure you to buy what is essential and save money. Photo courtesy of Alexandra Maria via Pexels

Make sure you to buy what is essential and save money. Photo courtesy of Alexandra Maria via Pexels

Ideal for shopaholics who struggle to save money, this challenge involves saving the amount spent on each non-essential purchase.

For example, before you buy a pair of stilettos worth Php5,000, ask yourself if you can add five thousand bucks to your savings account. If you can do both, then go ahead with the purchase and make sure you actually save the amount. If the answer is no, put those shoes back on the shelf and walk away.

Which of these nine money-saving challenges appeal most to you? Whatever you choose, make sure to stick to it and avoid touching your savings. Your success depends not only on the strategy itself but also your discipline in saving money. Grow your savings further by investing your money in mutual funds, stocks, and other investment channels. When things get really challenging, always keep your end-goal in mind: to buy your dream condo.